Property Buying and Selling Guides

First Time Home Buyers

- The Purchase Process For First-Time Home Buyers

- Government's Assistance For First-Time Home Buyers

- How to Buy a House in Malaysia?

- The Must-Know Basics of Home Loans

- A-Z of Property-Related Terms

- Malaysia Property Types

Property Buying & Selling Articles

- Are you a Property Flipper or Keeper?

- Reasons To Get Into Investment Property

- Why Invest In Property In Malaysia?

- Selling Your Property

- Should You Buy Property Near An MRT Station?

- Top 10 Tips on Investing in Iskandar Malaysia

Property Renting Articles

Expat Articles/ MM2H

Property Buying and Selling Guides

Tips and Guides > Buying and Selling Guides > Buying & Selling Articles> Are you a Property Flipper or Keeper?

Are you a Property Flipper or Keeper?

There are essentially two types of property investors - a flipper and a keeper. You could be both (employ both strategies) or choose to be just one of them, depending on your investment personality, investment goals and/or opportunities presented by the existing market.

Flipping is purchasing a property for a resale profit. These properties are usually the ones with the highest capital appreciation/gain in the shortest amount of time. The duration can range between a few months to a few short years. Additionally, if you buy a property at a bargain price, it can often be "flipped"/sold to another buyer for a profit within a few days or weeks. Do bear in mind that you will have to pay real property gains tax (RPGT) if you flip before the fifth year of purchase.

RPGT, as proposed in Budget 2014

Duration

Personal

(Citizens &

Permanent

Residents)

(Citizens &

Permanent

Residents)

Personal

(Non-citizens)

Company

Disposed within 3 years

Disposed in 4th year

Disposed in 5th year

Disposed after 5 years

30%

20%

15%

0%

30%

30%

30%

5%

30%

20%

15%

5%

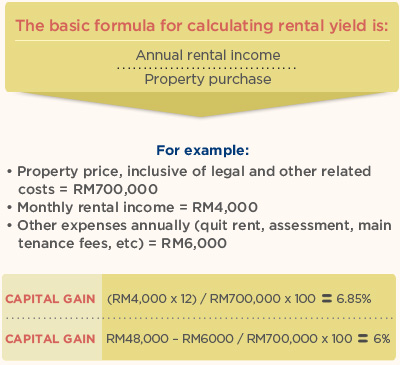

On the other hand, keeping is purchasing a property to hold on to for at least a year, often for many years, with the intention of profiting from renting the property out. These properties are the ones that fetch rental returns higher than 6%. These are usually high-rise developments such as apartments and condominiums.

It is important to decide your strategy before deciding on the types of properties that you want to invest in. You should also estimate the returns of investment you desire and your exit strategies. One of the most important factors in property investment success is to gather enough good information from the marketplace.

* All data and information is correct at time of upload. These articles are for information and basic educational purposes only.

Consumer experiences may differ depending on location or other factors.

Consumer experiences may differ depending on location or other factors.

<< Back to main page