Property Buying and Selling Guides

First Time Home Buyers

- The Purchase Process For First-Time Home Buyers

- Government's Assistance For First-Time Home Buyers

- How to Buy a House in Malaysia?

- The Must-Know Basics of Home Loans

- A-Z of Property-Related Terms

- Malaysia Property Types

Property Buying & Selling Articles

- Are you a Property Flipper or Keeper?

- Reasons To Get Into Investment Property

- Why Invest In Property In Malaysia?

- Selling Your Property

- Should You Buy Property Near An MRT Station?

- Top 10 Tips on Investing in Iskandar Malaysia

Property Renting Articles

Expat Articles/ MM2H

Property Buying and Selling Guides

Why Invest in Property in Malaysia?

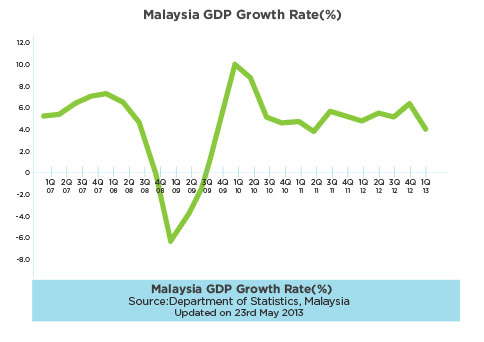

The value-driven real estate market with sustainable growth potential has made Malaysia an attractive property investment destination and option for investors. Malaysia's economy remained on a steady path in the first quarter of 2013 by registering a growth of 4.1%. According to a new World Bank report, Malaysia's gross domestic product (GDP) is expected to grow by 5.1% for both 2013 and 2014, driven by higher consumer and business spending.

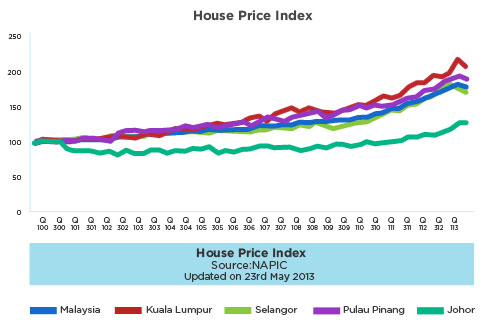

While the housing index in Malaysia reported a decrease amounting to 6% in the first quarter of 2013, compared to 12.2% in the last quarter of 2012, Bank Negara Malaysia, the central bank forecasts a rise to 9.31% by the year-end.

The Malaysian property market remains positive even after the much-awaited Election 2013. The Malaysian housing market remains strong, although the rate at which house prices are rising is now slowing down, mainly due to stricter lending guidelines including the 70% loan cap on the margin of financing for one’s third property onwards, and the revised real property gains tax (RPGT) of 15% for properties sold within two years and 10% for properties sold between two and five years. Banks are also using net income instead of gross income to calculate the debt service ratio for loans.

The MM2H programme has removed many of the obstacles preventing foreign investors from purchasing property in Malaysia and offers several substantial incentives including the removal of capital gains tax on properties owned for more than 5 years.

Up to 10%, and in some cases even higher rental returns, can be found on newly constructed developments in Malaysia.

In certain states of Malaysia, capital appreciation has been seen as high as 35%, exceeding the annual

expectations of 25%-30%. Expectations for the coming years are continuing at conservative 20%-30%.

There are numerous options in Malaysia when it comes to financing, from traditional mortgage solutions offered by local and western banks to the Islamic banks mortgage solutions, which are becoming increasingly popular amongst foreign investors.

Bank Negara Malaysia has kept its overnight policy rate (OPR) unchanged at 3% for ten consecutive meetings.

More land for less money, especially for investors from Singapore and Hong Kong, where land is scarce. Foreign investors are also able to own landed and freehold properties in Malaysia.

Savvy overseas buyers and investors have found the pricing of luxury seafront properties in Malaysia extremely attractive, affording them access to prime properties that would otherwise be unattainable in their home or other countries or elsewhere.

Sources

• Malaysia Property Inc

• Singapore Business Review

• Department of Statistics Malaysia

• Global Property Guide

* All data and information is correct at time of upload. These articles are for information and basic educational purposes only.

Consumer experiences may differ depending on location or other factors.

Consumer experiences may differ depending on location or other factors.

<< Back to main page

Some believe that the property sector in the Klang Valley will be driven by infrastructure projects, Johor Bahru by developments in Iskandar Malaysia, Malacca by tourism and Kota Kinabalu is benefiting from new infrastructure projects. For the residential sector, property prices will continue to rise 10 to 15% this year.

Some believe that the property sector in the Klang Valley will be driven by infrastructure projects, Johor Bahru by developments in Iskandar Malaysia, Malacca by tourism and Kota Kinabalu is benefiting from new infrastructure projects. For the residential sector, property prices will continue to rise 10 to 15% this year.